- Home

- Foreign Service Benefit Plan

- New Member

Welcome to the Foreign Service Benefit Plan

Your premier health insurance plan

Congratulations!

By choosing the Foreign Service Benefit Plan (FSBP) you have selected outstanding health and wellness care for you and your family.

Follow the steps below so you can begin taking advantage of your FSBP health coverage.

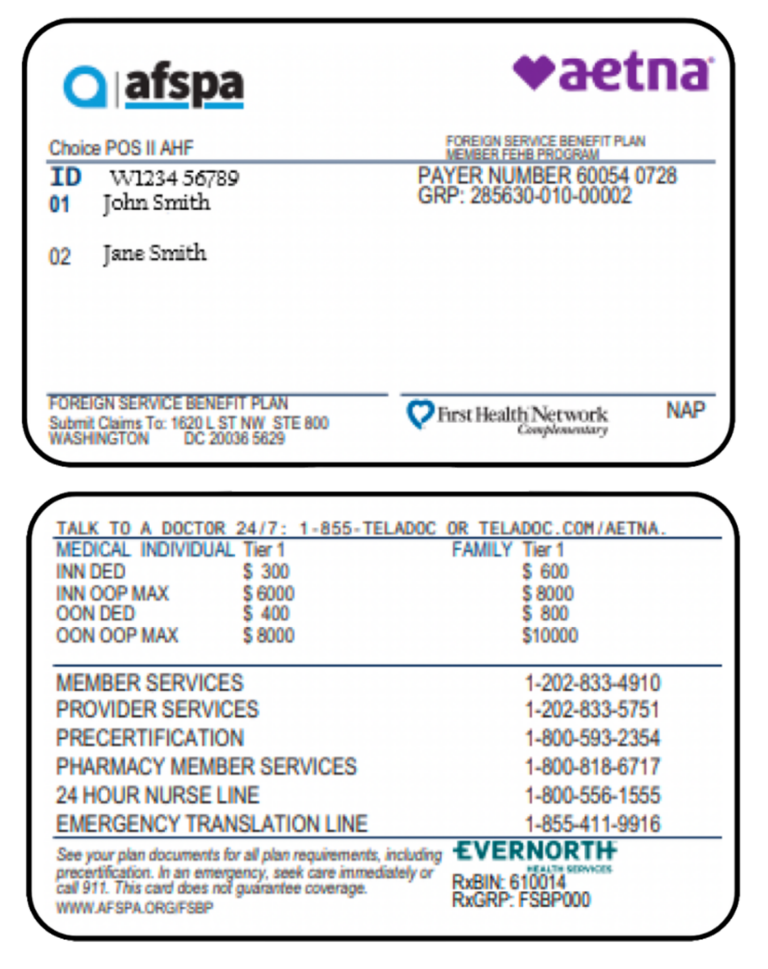

FSBP's Administrator, Aetna, will mail you your member ID card shortly.

- The ID card will have your member ID number, which you will need for all your health interactions. Always make sure to keep your ID card with you.

- Show your ID card to your health care providers and pharmacies.

- Have your ID card handy when contacting an FSBP Health Benefits Officer with any questions.

- If you do not receive your ID card in the next two weeks, please contact our Member Quality Services team at 202-833-4910.

AFSPA Member Portal

- Update your contact info (email, mailing address, contact numbers)

- Submit online claims

- Single Sign On (SSO) feature for all member portals

- Send/receive secure messages from AFSPA

- Manage enrollment for AFSPA Ancillary plans

Aetna Secure Member Website

- Access benefit usage (deductibles & out-of-pocket maximums)

- Check status of claims

- View your Explanation of Benefits (EOB)

- Request a copy of your Health ID card

- Access wellness programs and tools

Express Scripts Online

- Review your prescription plan coverage

- Get information about your estimated medication costs

- Order prescription refills, renewals, and check order status

- Find participating retails pharmacies

- View prescription claims, balances and history

Electronic Funds Transfer (EFT) Form

- This form allows us to deposit reimbursements directly into your U.S. bank account

- Get reimbursed faster, reducing paper and time

Authorization for Release of Protected Health Information (PHI ) Form

- This form allows us to provide information about your claims to a representative or family member*

- Mail to the address on the bottom of the form

Express Scripts (ESI) Home Delivery Mail Order Form

- This form allows you to get up to a 90-day supply of the prescriptions you take regularly for a single home delivery co-payment

- Offers free standard shipping

Finding Care in the U.S.

FSBP works closely with Express Scripts (ESI) to provide with quality and affordable pharmacy benefits. Members have convenient access to a network of retail pharmacies for up to a 30-day supply of medications. Members have access to ESI’s participating Smart90® retail network pharmacies or home delivery for up to a 90-day supply of non-specialty maintenance medications.

If your provider is in-network, generally, your provider will bill us with the appropriate information. If we need more information, we will contact your provider or you directly.

If your provider is out-of-network or overseas and is not one of our Direct Billing Partner, you should obtain a fully itemized bill prepared by the provider. We encourage you to submit your claim electronically via the AFSPA Member Portal for the quickest processing.

Finding Care Overseas

FSBP 2026 Premiums

| Enrollment | ENROLLMENT code | Bi-Weekly | Monthly |

|---|---|---|---|

| Self Only | 401 | $100.36 | $217.45 |

| Self Plus One | 403 | $257.96 | $558.91 |

| Self & Family | 402 | $248.27 | $537.93 |

What we offer

Request a Call Back

I am satisfied with the service FSBP provides and their claim handling procedures. I have dealt with other carriers before, and thus far, FSBP is the best that I have worked with. In my opinion, FSBP is the best for overseas members.

Tom K.

I was already a big fan of FSBP but my HBO's perseverance in getting my case handled has made me an even more loyal member! It is the best customer service I have ever had! I am deeply and sincerely grateful.

Satisfied Member

FSBP Coverage & Benefits

| YOU PAY |

|---|

| Medical Services | In-Network (Aetna Choice POS II in U.S. , Netcare in Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Preventive care, to include one mental wellness screening, routine immunizations, and tests (includes dietary & nutritional counseling) | Nothing | 30% of our allowance and any difference between our allowance and the billed amount* | Nothing |

| Office & Telemedicine visits - all covered diagnostic, professional, and treatment services | 10% of our allowance* | 30% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| Walk in Clinic | 10% of our allowance* | 30% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| Lab, X-ray, and other diagnostic tests | Nothing at LabCorp & Quest Diagnostics (U.S. only) 10% of our allowance at other network facilities* | 30% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| Telehealth | Nothing when using Teladoc®️ provider (U.S. Only) | No benefit | Nothing when using vHealth (Worldwide) for general medicine and Lyra for behavioral health services |

| Complete maternity (obstetrical) care | Nothing Doula services covered up to $1,200 per calendar year | 30% of our allowance and any difference between our allowance and the billed amount | Nothing Doula services covered up to $1,200 per calendar year |

| Basic Infertility and Advanced Reproductive Technology (ART) Note: For Basic Infertility, members will not need prior authorization and services can be rendered by either an in-network or out-of-network provider. ART services require prior authorization and services must be rendered by an Institute of Excellence (IOE) Infertility provider. | 10% of our Plan allowance after deductible is met | Basic infertility: 30% of our allowance and any difference between our allowance and the billed amount ART services: no benefit | 10% of our Plan allowance after deductible is met |

| YOU PAY |

|---|

| Hospital Services | In-Network (Aetna Choice POS II in U.S. , Netcare in Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Inpatient | Nothing | $200 copayment per hospital admission and 20% of the Plan allowance and any difference between our allowance and the billed amount | Nothing |

| Outpatient - Surgical | 10% of our allowance* | 30% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| Outpatient - Medical | 10% of our allowance* | 30% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| YOU PAY |

|---|

| Emergency Benefits | In-Network (including Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Accidental injury: Initial treatment in an emergency room, urgent care center or doctor’s office, including physician’s charges/ancillary services | Nothing | Only the difference between our allowance and the billed amount | Nothing |

| Medical emergency | 10% of our allowance* | 10% of our allowance and any difference between our allowance and the billed amount* | 10% of our allowance* |

| Urgent care center | $35 copay per occurrence | $35 copay per occurrence and any difference between our allowance and the billed amount | $35 copay per occurrence |

| YOU PAY |

|---|

| Mental Health and substance abuse | In-Network (Aetna Choice POS II in U.S. , Netcare in Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Diagnostic, professional, and treatment services | 10% of our plan allowance* | 30% of our plan allowance and any difference between our allowance and the billed amount | 10% of our plan allowance* |

| Telehealth (behavioral health services) | Nothing when seen from a Teladoc® provider (U.S. only) | All costs (no benefit) | Nothing when seen from a Lyra provider |

| Inpatient hospital | Nothing | 20% of our plan allowance and any difference between our allowance and the billed amount for room and board and other services | Nothing |

| YOU PAY |

|---|

| Prescription drugs | Retail network pharmacies in the U.S. (up to 30-day supply) | Home Delivery (mail order through express scripts pharmacy or smart 90 retail (up to 90-day supply) |

|---|---|---|

| Tier 1 - Generic | $12 copay | $20 copay |

| Tier II - Preferred | 35% ($150 max) | 35% (300 max) |

| Tier III - Non Preferred Brand | 45% ($300 max) | 45% ($400 max) |

| Tier IV - Generic Specialty | 35% ($240 max) | 35% ($240 max) |

| Tier V - Preferred Specialty | 35% ($240 max) | 35% ($240 max) |

| Tier VI - Non-Preferred Specialty | 50% ($480 max) | 50% ($480 max) |

| YOU PAY |

|---|

| Chiropractic & Alternative Services | In-Network (Including Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Massage therapy, chiropractic, and acupuncture - limited to 50 visits for each service , per person, per calendar year | The difference between the billed amount and plan maximum benefit of $75 per visit , per service, per calendar year | The difference between the billed amount and plan maximum benefit of $75 per visit , per service, per calendar year | The difference between the billed amount and plan maximum benefit of $75 per visit , per service, per calendar year |

| YOU PAY |

|---|

| Dental Care | In-Network | Out-of-network | Outside the 50 U.S. |

|---|---|---|---|

| Routine preventive care and surgical procedures | The difference between our scheduled allowances and the actual billed amounts | The difference between our scheduled allowances and the actual billed amounts | The difference between our scheduled allowances and the actual billed amounts |

| Orthodontics | 50% of our allowance up to our maximum payment of $1,000 per course of treatment and 100% after our maximum payment of $1,000 | 50% of our allowance up to our maximum payment of $1,000 per course of treatment and 100% after our maximum payment of $1,000 | 50% of our allowance up to our maximum payment of $1,000 per course of treatment and 100% after our maximum payment of $1,000 |

| Annual Calendar Year Deductible |

|---|

| Enrollment Type | In-Network (including Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Self Only (401) | $300 | $400 | $300 |

| Self Plus One (403) | $600 | $800 | $600 |

| Self & Family (402) | $600 | $800 | $600 |

| Catastrophic Protection Out-of-pocket maximum |

|---|

| Enrollment Type | In-Network (including Guam) | Out-of-network (Including Guam) | Outside the 50 U.S. |

|---|---|---|---|

| Self Only (401) | $6,000 | $8,000 | $6,000 |

| Self Plus One (403) | $8,000 | $10,000 | $8,000 |

| Self & Family (402) | $8,000 | $10,000 | $8,000 |

*Subject to the calendar year deductible. In-network deductibles: $300 for Self Only, $600 for Self Plus One or Self and Family | Out of network deductibles: $400 for Self Only, $800 for Self Plus One or Self and Family

This is a summary of the features of the Foreign Service Benefit Plan. Before making a final decision, please read the Plan’s Federal brochure. All benefits are subject to the definitions, limitations, and exclusions in the Foreign Service Benefit Plan Brochure (RI 72-001).